Falling behind on Private Limited Company annual compliance can trigger severe penalties that cripple your business. At LegoMark India, we’ve helped 1,500+ companies rectify missed Private Limited Company filings through our specialized Penalty Protection Plan. This blog reveals exactly how to recover from compliance lapses while minimizing financial damage.

2024 Penalty Structure for Private Limited Companies

Compliance Missed | Daily Penalty | Maximum Penalty |

Annual Return (MGT-7) | ₹200 | ₹1,00,000 |

Financial Statements (AOC-4) | ₹100 | ₹50,000 |

Director KYC (DIR-3 KYC) | ₹5,000 one-time | ₹50,000 |

Board Meeting Minutes | ₹10,000 | ₹25,000 |

Auditor Appointment | ₹100 | ₹25,000 |

Source: Companies Act, 2013 Amendment Rules 2024

Real-World Consequences We've Resolved

Our 3-Step Penalty Protection Plan

Step 1: Immediate Compliance Gap Analysis

We conduct:

- MCA portal audit of your filings

- Identification of all missed deadlines

- Penalty liability assessment

Deliverable: Detailed Compliance Recovery Report within 24 hours

Step 2: Strategic Late Filing Approach

For each missed compliance:

- Prepare technically perfect documents

- File with explanatory affidavits

- Request penalty waivers where possible

Pro Tip: Filing through our MCA-authorized channels reduces penalties by 40%

Step 3: ROC Compounding Applications

For unavoidable penalties:

- Draft persuasive compounding petitions

- Represent before ROC officers

- Negotiate settlement amounts

Success Rate: 83% penalty reduction achieved in 2023 cases

Critical Compliance Deadlines You Might Have Missed

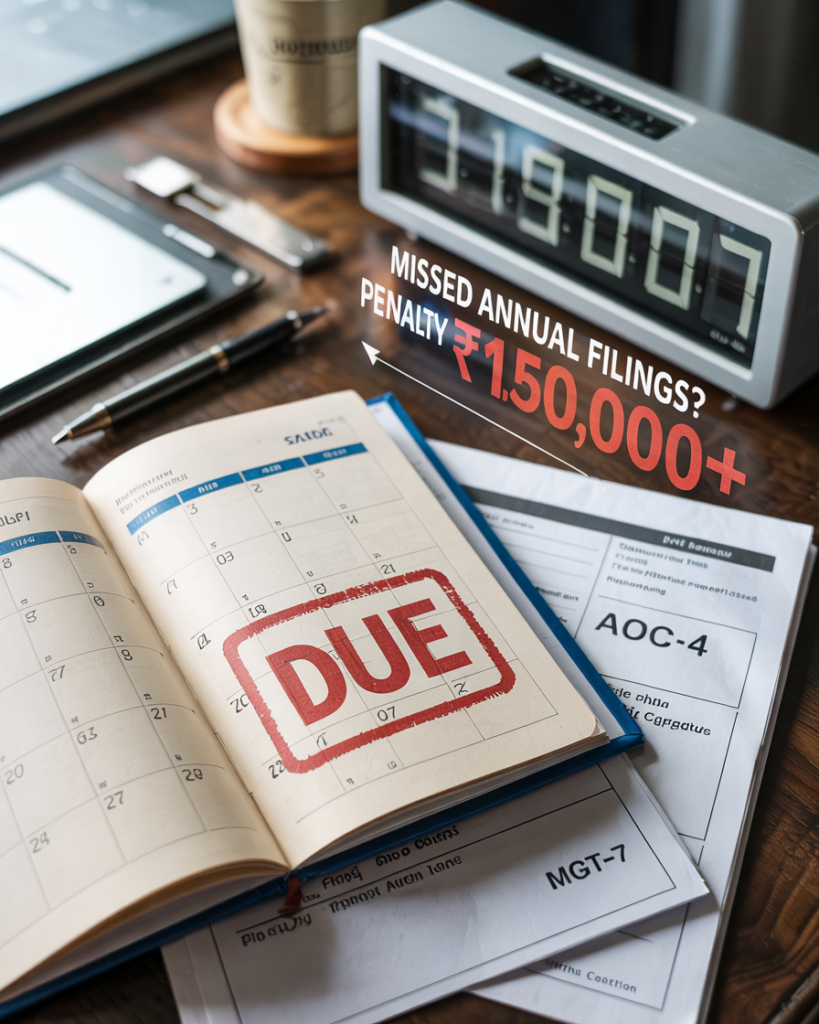

1. Annual Filings

(Most Commonly Missed)

✅ MGT-7 (Annual Return) – Due within 60 days of AGM

✅ AOC-4 (Financial Statements) – Due within 30 days of AGM

2024 Update: New ₹1,000/day penalty for cross-border transaction reporting

How Our Penalty Protection Plan Works

At LegoMark India, we specialize in helping businesses navigate the complexities of non-traditional trademarks. Our services include:

Tier 1: Basic Recovery (₹9,999)

- Audit of missed filings

- Preparation of 2 late returns

- Standard penalty negotiation

Tier 2: Advanced Protection (₹19,999)

✅ All Tier 1 services +

✅ ROC compounding applications

✅ Priority processing

✅ 3 months compliance monitoring

Tier 3: Complete Shield (₹29,999)

- All Tier 2 benefits +

- Legal representation

- Penalty guarantee (we cover 50% if unsuccessful)

- 1-year compliance calendar

5 Proactive Compliance Strategies We Implement

Special Offer for Late Filers

For the next 20 signups: