Introduction

Need a business loan?

Planning to apply for MSME credit, Startup India loans, or even working capital?

Here’s the truth no one tells you:

If you haven’t completed your Private Limited Company Registration, banks will reject your loan applications—almost instantly.

In the eyes of banks and NBFCs, you’re not a real business until you’re registered.

No matter how promising your startup idea is, no registration = no funding.

Let’s dig into why Pvt Ltd status is non-negotiable for getting loans—and how you can get started for just ₹7999.

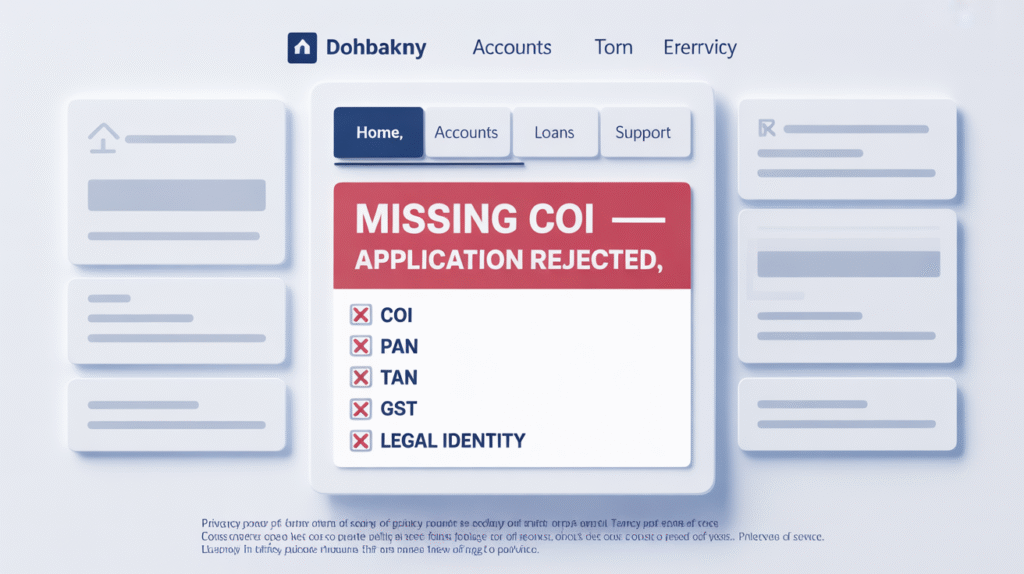

Why Banks Say “No” to Unregistered Businesses

Banks and financial institutions need:

✅ Certificate of Incorporation (COI)

✅ PAN, TAN, GST details

✅ Business bank account

✅ Company financials and audit trail

✅ Limited liability proof (Pvt Ltd structure)

If you don’t have these?

❌ Your application is rejected

❌ Your credit score won’t even be checked

❌ You miss access to pre-approved SME funding and startup grants

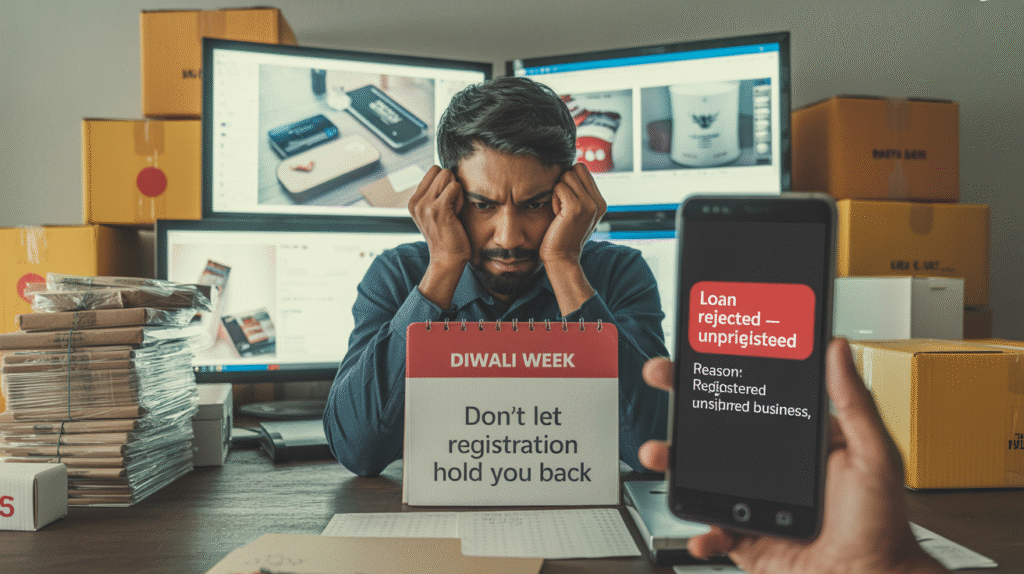

Real Case: ₹10L Business Loan Rejected in 10 Minutes

A profitable dropshipping business from Jaipur applied for a working capital loan.

They were:

- Making ₹2L/month

- Using Razorpay for transactions

- Running ads with strong ROI

But they were operating as a sole proprietorship. No Pvt Ltd company.

Bank response?

“Sorry, we don’t lend to unregistered entities.”

End result: No loan. Business stalled during Diwali rush.

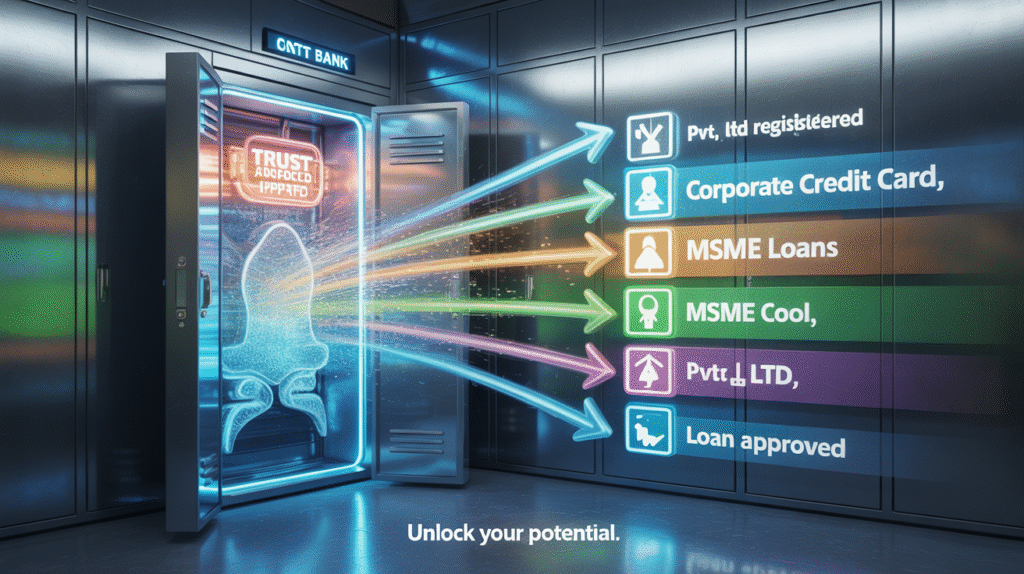

How Pvt Ltd Registration Unlocks Financial Power

🏦Business Bank Account Access

📈Eligibility for Mudra Loans, CGTMSE, and MSME Credit

🧾Proof of Legal Existence

💳Corporate Credit Card and Limit Eligibility

💼Increased Trust from Lenders & Vendors

📄Documentation Readiness for Fast Processing

With these, banks take your business seriously.

What You Risk by Skipping This Step

❌ No loan or funding access

❌ Personal credit exposed if borrowing as an individual

❌ Missed opportunities during seasonal growth peaks

❌ Ineligibility for emergency government business support

❌ Dependence on friends/family instead of financial institutions

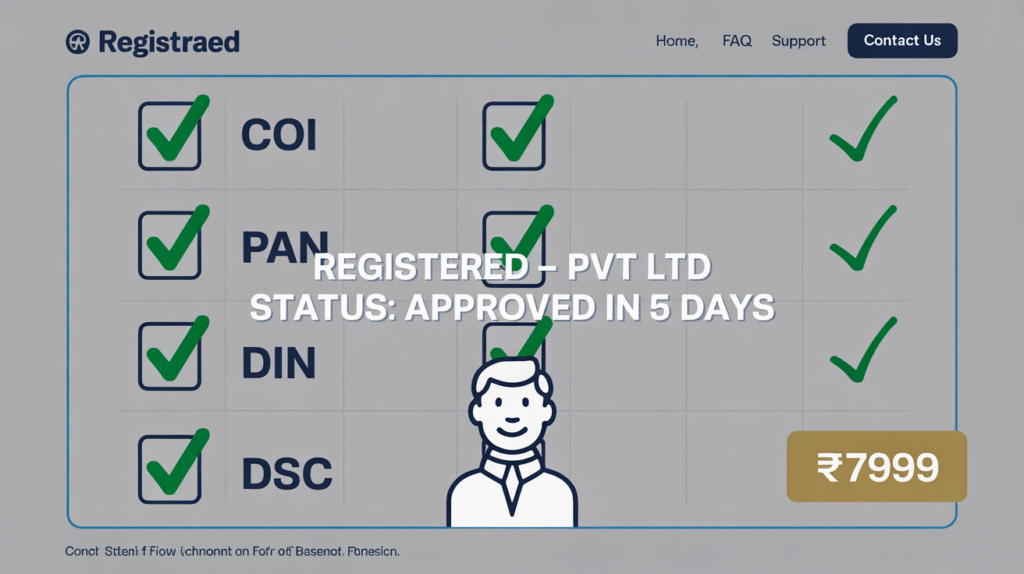

What You Get with LegoMark India

✅ End-to-end Pvt Ltd company registration

✅ PAN, TAN, COI, DIN, DSC included

✅ CA-led documentation and process

✅ Filing completed in 5–7 working days

✅ Fully online & stress-free

💰 All-inclusive price starting from ₹7999

✅Click here to become loan-ready today

FAQs

Q: Can I apply for a loan right after registration?

A: Yes. Many schemes only require a COI and initial bank statement.

Q: Is GST mandatory to apply for loans?

A: It helps, but for smaller loans or schemes like Mudra, just Pvt Ltd + bank records can be enough.

Q: What if I only have online income?

A: As long as you’re legally registered and can show transactions, you qualify.

Final Words

Banks love documents. Investors love structure. Clients love trust.

And it all starts with one move:

✅Register your Private Limited Company with LegoMark India

Don’t let a missing legal step block your business from serious financial growth.