Introduction

You’ve got a great product, happy clients, and steady cash flow.

But here’s the catch…

If your business isn’t officially registered as a Private Limited Company, you might be unknowingly violating Indian business laws.

In this blog, we’ll walk you through the legal risks of running an unregistered business—and how you can avoid penalties, lawsuits, and compliance issues by simply registering your company today.

Why Operating Without Registration Could Be Illegal

Many entrepreneurs believe that if they’re small or just starting out, they don’t need to register.

That’s false—and risky.

Here’s what you might be doing wrong:

⚠️Issuing invoices without a legal entity

⚠️Avoiding or mismanaging GST compliance

⚠️Hiring without proper employment records

⚠️Taking payments into a personal account

⚠️Signing contracts that aren’t legally valid

Each of these can lead to penalties, bans, or even lawsuits.

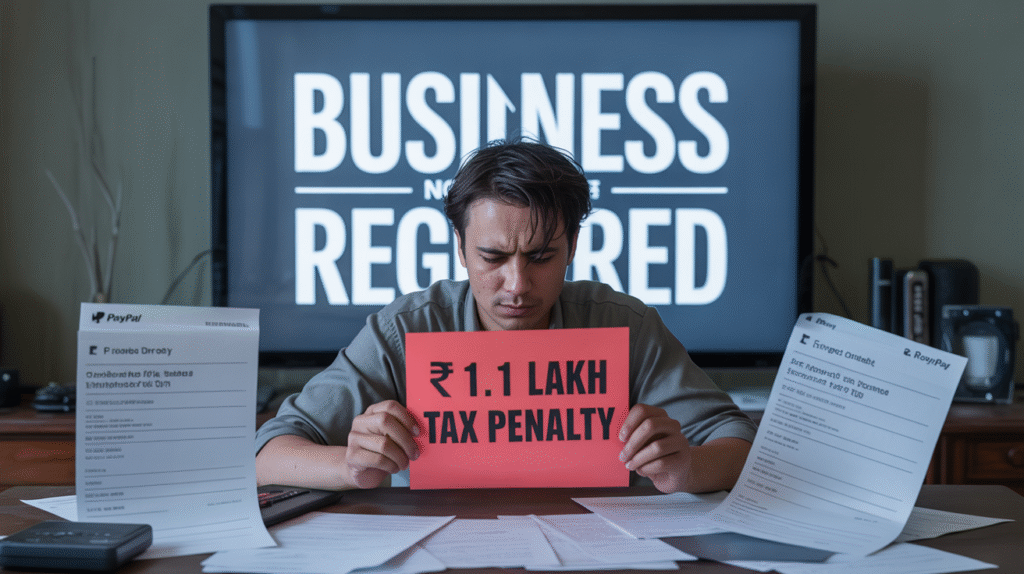

Real-Life Story: The Freelance Agency That Got Penalized

A digital marketing agency in Bengaluru was generating ₹50L+ annually through personal accounts and invoice templates.

But during a vendor audit, one client flagged their lack of business registration.

Soon, they faced:

- ₹1.1 lakh in tax penalties

- Loss of multiple clients

- Suspension from PayPal and Razorpay

They registered late—but by then, the damage was done.

Don’t let this happen to you.

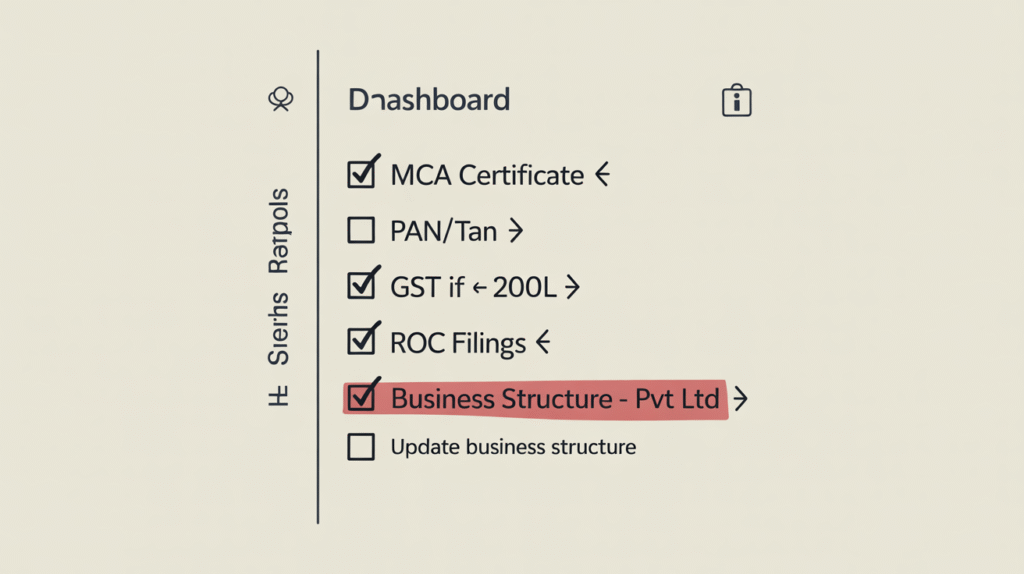

What the Law Expects From Business Owners

✅ Proper registration under MCA (Ministry of Corporate Affairs)

✅ PAN and TAN for tax compliance

✅ GST if turnover exceeds ₹20L

✅ ROC (Registrar of Companies) filings

✅ Legal structure for issuing invoices, hiring, and partnerships

Operating without this framework can lead to legal violations—even if you didn’t mean to break the law.

What Pvt Ltd Registration Fixes Instantly

✅ Gives your business a separate legal identity

✅ Brings you under full MCA compliance

✅ Enables tax filing, invoicing, hiring, and agreements

✅ Makes your operations 100% legal and scalable

✅ Protects you from personal liability

Why You Shouldn’t Wait

📉 The bigger your business grows, the more you’re exposed

📩 All it takes is one tax notice or platform ban

⚖️ Courts only recognize legal business structures

🏦 Banks, clients, and partners need registered business documents

Don’t wait to be flagged. Register now and operate with confidence.

Why Founders Choose LegoMark India

📄 Includes DIN, DSC, PAN, TAN & COI

🕒 Company incorporation in 5–7 working days

💼 MCA-compliant registration process

💻 100% online – zero paperwork

💰 Starts at ₹7999 only

FAQs

Q: What if I’m already paying taxes as an individual?

A: That doesn’t make you a registered business. You’re still personally liable.

Q: Can I register after I start my business?

A: Yes. But sooner is safer—legally and financially.

Q: What if my business is online only?

A: Doesn’t matter. Even online brands must be legally registered to operate fully.

Final Words

Not registering your business isn’t just risky—it might be illegal.

The good news? You can fix it in just a few days.

✅Register your Pvt Ltd company with LegoMark India and turn your hustle into a legally recognized business.